Artificial intelligence is scaling faster than almost any technology in history, but its growth has a physical limit most investors overlook: power. Every model, server, and data center depends on electricity that must be constant, scalable, and politically acceptable. As AI workloads surge, grids are straining, contracts are tightening, and energy availability is quietly becoming the gating factor. This is not a distant risk—it is already shaping where AI can and cannot expand. Nuclear power, once dismissed, is moving back into the center of the conversation. Not as a trade—but as infrastructure.

The last part of this newsletter explains why owning the right layer of the power stack matters more than predicting the following AI headline.

Let’s embark on this transformative journey together and position your portfolio for success in this evolving market landscape!

Be sure to read through to the end to catch all the valuable insights this newsletter delivers to your inbox today.

LLY's Breakthrough Momentum: $500 Monthly Bets Turn Dips into Five-Year Health Wins

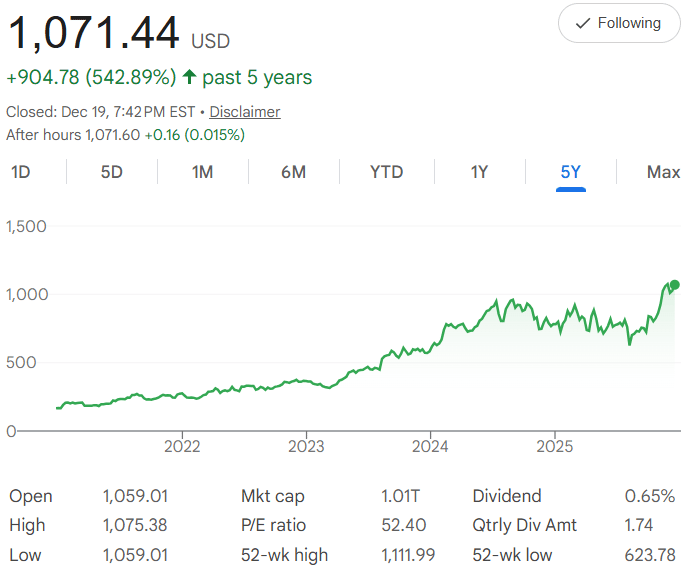

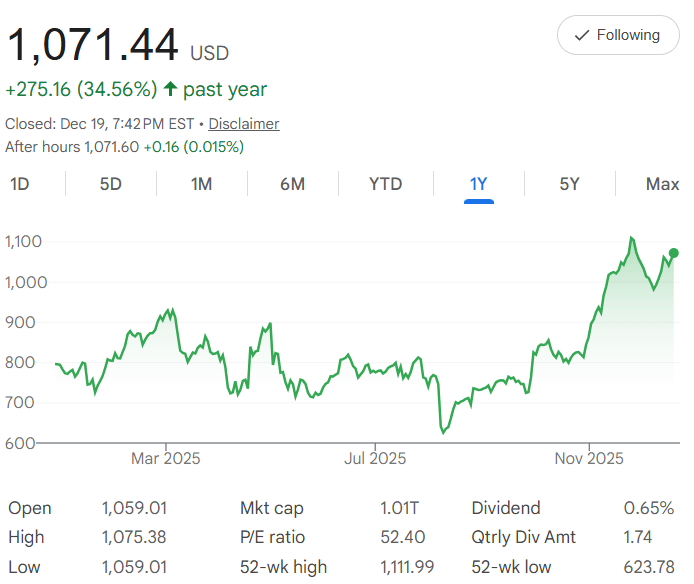

Five years ago, Eli Lilly and Company $LLY ( ▲ 2.27% ) shares were around $166.66 each. As of December 19, 2025, it's closed at $1,071.44—a huge 543% surge fueled by runaway success of weight-loss drugs Mounjaro and Zepbound, plus advancing treatments in diabetes, oncology, and Alzheimer's. Now, look at the one-year chart for the real lesson: Starting January 2025 near $800, it climbed steadily to spring highs around $950, dipped through summer to lows near $700 on market worries or competition fears, then rocketed past $1,000 in fall-winter for a net 34.56% gain. After-hours at $1,071.60 shows the pull, but the rebound highlights strength—with the 52-week high of $1,111.99 already hit and low at $623.78 far below, it's clear short-term dips are just pauses in a powerful uptrend.

The five-year compound annual growth rate (CAGR) is 45.03%, the steady average yearly lift (total growth raised to 1/5 power, minus 1) that rewards backing innovation—about 45% growth per year.

Dollar-cost averaging (DCA) is your prescription: Keep $500 flowing monthly for five years, totaling $30,000. Those summer dips to $700? Perfect chance to buy extra shares cheap, lowering your average cost while peaks like November take smaller portions. From $1,071.44, at a 3.16% monthly growth rate, it all compounds.

In 60 months, your stake could reach $85,622—a $55,622 profit and 185% return. Early investments get the deepest boost, but dip buys like mid-year supercharge the recovery.

The vital message: If you trust Eli Lilly to deliver—launching better drugs, winning approvals, and growing through science breakthroughs—keep investing regularly, no matter short-term drops. In fact, buy more when prices fall, turning those chart valleys into your strongest medicine. Over five years, the odds favor product upgrades and market wins that drive the stock higher.

With a $1.01T market cap, P/E of 52.40 reflecting big bets, and 0.65% dividend yield, your DCA could heal into a robust reward by 2030. Stay the course?

🔋🚀AI’s Growth Curve Has a Hidden Ceiling

Artificial intelligence is often discussed as a compute race—chips, models, and cloud infrastructure. But beneath every server rack sits a constraint that cannot be optimized away with software: electricity.

Data centers now exceed 12,000 globally, including nearly 1,200 hyperscale facilities operated by Amazon, Microsoft, Google, and Meta. These sites consumed roughly 415 terawatt-hours of electricity in 2024, representing about 1.5% of global power demand. By 2030, that figure is projected to rise to 950 terawatt-hours, exceeding the total electricity consumption of Japan today.

In the United States alone, data center demand is expected to surge from 183 TWh to 426 TWh, a 133% increase in just six years.

This is not a theoretical projection. Power contracts are already being signed. Grid bottlenecks are forming. Energy availability is becoming a gating factor for AI deployment.

When energy must be clean, always-on, scalable, and politically viable, the menu of solutions narrows quickly. Solar and wind struggle with intermittency. Natural gas faces emissions pressure. Grid expansion is slow.

That is why nuclear—once sidelined—is re-emerging as core infrastructure rather than a speculative energy bet.

Nuclear Is Not One Industry, It Is a Stack

Nuclear power does not scale through a single breakthrough. It scales through a layered system, where each rung enables the next. Understanding this structure matters more than guessing which ticker will move next.

At the base sits uranium mining. Without extraction, nothing moves. No fuel, no reactors, no electricity. This tier responds most directly to supply shortages and contracting cycles.

Above mining is the fuel and enrichment layer—conversion, enrichment, and fabrication. This is the system’s true choke point. Uranium in the ground is useless until it is transformed into reactor-ready fuel. Capacity constraints here limit how fast nuclear can grow, regardless of how much uranium exists.

Next comes the innovation layer: small modular reactors (SMRs) and microreactors. These designs aim to compress nuclear from multi-billion-dollar mega projects into deployable systems that can be colocated with factories or data centers. The potential is enormous, but timelines are long and regulatory risk is real.

At the top are the utilities—licensed operators already producing gigawatts of baseload power today. These companies are signing long-term contracts with hyperscalers that need guaranteed electricity, not future promises. This is where cash flow lives now.

Each tier behaves differently, reacts to different catalysts, and rewards capital on different timelines.

Broad Exposure and Supply Torque

For investors seeking nuclear exposure without managing multiple positions, some ETFs provide structural clarity rather than thematic noise.

The Global X Uranium ETF $URA ( ▼ 3.65% ) functions as a benchmark. It blends heavy exposure to miners with selective exposure to fuel services and utilities. With fees around 0.69%, a 1.69% dividend, and strong liquidity, it offers diversified access without requiring precision timing. Its performance—up sharply in recent years—reflects what happens when uranium tightens and nuclear is reclassified as infrastructure.

For more direct supply leverage, the Sprott Uranium Miners ETF (URNM) focuses almost entirely on producers and physical uranium exposure. This is the purest expression of tier-one dynamics: production cuts, contracting cycles, and long-term demand imbalance. Its performance tends to accelerate quickly when sentiment turns—and cool just as fast.

At the far end of the risk spectrum sits the Sprott Junior Uranium Miners ETF (URNJ). This fund is composed of early-stage developers and explorers—companies defining resources that may not produce for years. Volatility is high. Upside can be dramatic. This tier exists to supply the future, not the present.

These ETFs do not solve the entire nuclear scaling challenge—but they underpin it.

Where Electricity Becomes Revenue

At the opposite end of the stack sits the VanEck Uranium and Nuclear ETF $NLR ( ▼ 3.12% ) , dominated by utilities already operating nuclear plants. Companies such as Constellation, Duke Energy, Entergy, and Dominion generate electricity today and sell it under long-term frameworks.

This tier behaves differently. It rarely spikes. It rarely collapses. It compounds. With lower fees and modest yield, it reflects regulated stability rather than commodity volatility. As AI demand grows quarter after quarter, this is the layer where rising energy consumption translates most directly into dependable revenue.

Between supply and utilities lies the most overlooked segment: fuel infrastructure and next-generation reactors.

The Global X Uranium and Nuclear ETF $NUKZ ( ▼ 1.84% ) occupies this middle ground, providing exposure to enrichment, fuel services, and reactor innovation. This tier determines whether nuclear can scale fast enough to meet AI demand. Without enrichment capacity and deployable reactor designs, mining alone cannot close the energy gap.

This is also the slowest-moving tier—constrained by regulation, capital intensity, and permitting timelines. Analysts remain conservative here for a reason. But without this layer, the system bottlenecks.

Owning the Constraint, Not the Headline

The most important insight is not which ETF performed best this year. It is why each one exists.

Mining responds to scarcity. Fuel responds to capacity. Innovation responds to scalability. Utilities respond to demand certainty.

They do not peak together. They do not decline together. And they should not be owned emotionally.

If AI continues on its projected trajectory—doubling, tripling, or more—energy demand will not be solved by a single tier. Uranium alone is insufficient. Utilities alone cannot expand without fuel. Innovation without infrastructure remains theoretical.

The nuclear opportunity is not about chasing the loudest corner of the market. It is about understanding which layer converts ambition into electrons on the grid.

For investors with limited time and limited tolerance for noise, frameworks outperform headlines. Owning the entire system intentionally, rather than guessing which piece will run next, creates durability in a sector defined by long cycles and structural constraints.

When intelligence scales, power becomes the bottleneck. Nuclear is no longer optional—it is foundational.

Ready to Revolutionize Your Wealth?

Here's what's waiting for you:

📈 Step-by-Step Guide: Start Investing in Minutes with Our Chosen Online Broker

🔍 Expert Insights: Uncover the Strategies Behind Our Recommended Smart Portfolios

💼 Easy Diversification: Gain Exposure to a Wide Range of Assets with Just a Few Clicks

💰 Long-Term Growth Potential: Build a Portfolio for Consistent Returns Over Time.

💸 Paying the bills

Refind - Brain food is delivered daily. Every day, we analyze thousands of articles and send you only the best, tailored to your interests. Loved by 510,562 curious minds. Subscribe.

The best trades require thorough research, followed by a commitment.

TOP MARKET NEWS

Top Market News - December 24, 2025

Hedge Funds and Banks Drive Growth in Crypto ETF Trading

Institutional players like hedge funds and major banks are fueling explosive trading volumes in crypto ETFs, signaling mainstream adoption and deeper liquidity in digital asset products.

Tip: Consider a small 1-3% allocation to spot Bitcoin or Ethereum ETFs for retirement diversification; focus on regulated vehicles to benefit from institutional inflows without direct crypto custody risks.

Fab 5: Todd Rosenbluth’s Top ETF Stories of 2025

Key 2025 ETF trends include active management dominance, thematic launches in AI and alternatives, fee compression, international flows, and the rise of buffered/defined-outcome products amid volatility.

Tip: Lean into active and buffered ETFs for retirement protection in uncertain markets; allocate 10-20% to themes like AI or alternatives for growth potential while keeping core passive for cost efficiency.

Stock Market Today: Nasdaq, S&P 500, Dow Futures Rise as Tech Recovers While Gold Hits Record

Futures point higher with tech rebounding from recent dips, while gold surges to all-time highs amid safe-haven demand; broader indices show resilience heading into the holidays.

Tip: Use holiday quiet periods to rebalance retirement portfolios; add to beaten-down tech if overweight cash, and consider a 5% gold allocation as inflation/geopolitical hedge.

Is the Stock Market Open for Christmas? Here’s the Holiday Trading Schedule

Markets close early at 1 p.m. ET on Christmas Eve (Dec. 24) and remain fully closed on Christmas Day (Dec. 25); normal hours resume Dec. 26 with bond markets following similar patterns.

Tip: Complete any year-end tax-loss harvesting or rebalancing before early close today; enjoy the break and review 2025 goals when trading resumes.

Advertise with Investing Wise Academy

Elevate your financial brand with targeted exposure to savvy investors and market enthusiasts. Join us early for premium discounts and a compelling story that lands in the right inboxes. Let’s grow together!

Partner with UsPROMO CONTENT

Can email newsletters make money?

With the world becoming increasingly digital, this question will be on the minds of millions of people looking for new income streams in 2025.

The answer is—Absolutely!

That’s it for this episode!

Thank you for taking the time to read today’s email! Your support is what allows me to send out this newsletter for free every day.

What do you think of the new format? Please provide your feedback in the poll below, and if you find the newsletter valuable, feel free to share it with other investors!

How would you rate today's newsletter?

Disclaimer: This newsletter is for informational purposes only and should not be considered financial advice. Please consult with a financial advisor before making any investment decisions.