Investing doesn’t have to feel like a full-time job. While most investors chase hot tips, trade frequently, or try to outsmart the market, decades of data show simplicity outperforms complexity. Enter VTI and VXUS—two ETFs that together offer exposure to over 12,000 companies worldwide, from U.S. giants to emerging-market innovators. With low fees, automated investing, and global diversification, these funds allow your capital to compound quietly while you focus on life, not charts.

The final section reveals a simple allocation strategy and automation approach that even busy investors can use to capture decades of global growth without overthinking. Read the full newsletter to see how two ETFs can power your long-term wealth.

Let’s embark on this transformative journey together and position your portfolio for success in this evolving market landscape!

Be sure to read through to the end to catch all the valuable insights this newsletter delivers to your inbox today.

Close more deals, fast.

When your deal pipeline actually works, nothing slips through the cracks. HubSpot Smart CRM uses AI to track every stage automatically, so you always know where to focus.

Simplify your pipeline with:

Instant visibility into bottlenecks before they cost you revenue

Clear dashboards highlighting deals in need of the most attention

Automatic tracking so your team never misses a follow-up

Start free today. No credit card required.

TMDX’s Organ Care Revolution: Can a $500 Monthly Bet Lifeline a Fortune by 2031?

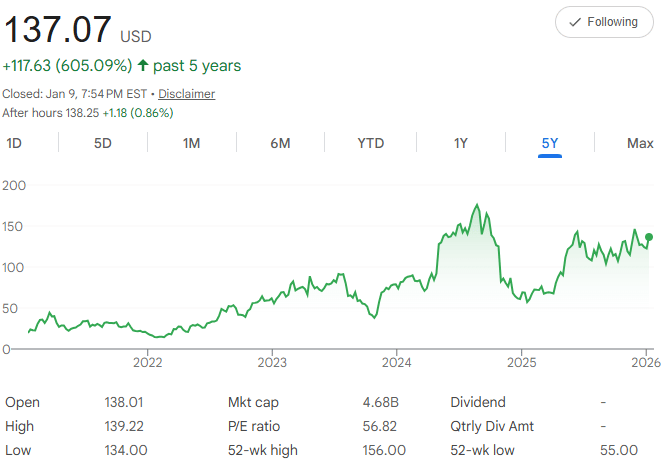

Five years ago, TransMedics Group $TMDX ( ▲ 7.94% ) shares were trading at a much humbler $19.00, but as of today, the stock closed at $137.07—marking a phenomenal 621.42% rise fueled by its revolutionary Organ Care System (OCS) and a growing $4.68B market cap.

This aggressive climb reflects a Compound Annual Growth Rate (CAGR) of 48.47%, meaning your money would have grown by nearly 50% each year on average as the company transformed organ transplantation logistics. By following a dollar-cost averaging (DCA) strategy and committing $500 every month for five years (totaling $30,000), you would have leveraged the stock's volatility, buying more shares during the 2025 pullbacks and fewer during its rapid vertical ascents.

Projecting forward at this historical pace with a monthly growth rate of approximately 3.35%, your total investment could reach $111,102 by 2031, resulting in a gain of $81,102—a 270.3% return.

While the medtech sector faces high R&D costs and a 52-week high of $156.00 shows the stock is currently consolidating, TransMedics’ expansion of its National OCS Program provides a massive operational tailwind; if you keep this steady drill running, your $500 monthly habit could turn into a life-changing windfall by 2031—but in the high-stakes world of medical innovation, will you be riding the next breakthrough or left waiting on the transplant list when the market cooling begins?

🌍📈Global Wealth Simplified: The Two ETFs That Do It All

Investing doesn’t have to feel like a full-time job. The majority of investors waste countless hours chasing hot tips, analyzing individual stocks, and reacting to daily market noise. Meanwhile, decades of data show that simplicity outperforms complexity. The SPIVA study, which benchmarks professional money managers against basic index funds, reveals a startling truth: over the past 15 years, more than 90% of actively managed large-cap funds failed to outperform a simple index fund.

That means nine out of ten professionals, equipped with teams, research tools, and advanced models, could not beat a strategy that a 12-year-old could implement in minutes. If the experts can’t consistently outperform the market, why are you overcomplicating your own investments?

Here’s the solution: two ETFs— $VTI ( ▼ 0.51% ) and $VXUS ( ▼ 0.18% ). Together, these funds offer exposure to over 12,000 companies worldwide, providing instant diversification across industries, countries, and market capitalizations. This is not a gimmick. It’s literally owning the global economy with just two purchases.

VTI: Owning the U.S. Economy

$VTI ( ▼ 0.51% ), the Vanguard Total Stock Market ETF, is the foundation. It tracks every publicly traded U.S. company—more than 3,600 in total—from giants like Apple and Nvidia to lesser-known small-cap innovators.

Key points about VTI:

Share price: Around $341 per share.

Expense ratio: 0.03% ($3/year for every $10,000 invested).

Recent returns:

2023: +26%

2024: +24%

2025: +17%

Owning VTI means you’re betting on the long-term growth of the American economy. It captures innovation, productivity, and consumer demand across multiple sectors. Unlike picking individual stocks, you are immune to company-specific failures because your exposure is broad.

However, here’s where investors often get it wrong: stopping at VTI alone. While the U.S. has performed exceptionally over the past decade, it represents only 60% of the global market. Ignoring international opportunities leaves part of the world’s growth untapped.

VXUS: The Power of Global Diversification

$VXUS ( ▼ 0.18% ) complements VTI by providing complete international exposure. This includes developed markets like Japan, Germany, and the UK, as well as emerging markets like India, Brazil, and China.

VXUS highlights:

Number of companies: ~8,500 across multiple countries.

Share price: Around $77 per share.

Expense ratio: 0.05% ($5/year for every $10,000 invested).

Dividend yield: ~2.7%, over double VTI’s yield.

International markets move in cycles. From 2000–2009, U.S. stocks underperformed significantly, while international stocks surged. By owning VXUS, investors safeguard against geographic concentration risk. Dividend payouts add a meaningful source of cash flow, compounding wealth while you wait for capital appreciation.

Suggested allocation example:

$10,000 portfolio: 70% VTI ($7,000) / 30% VXUS ($3,000)

Total annual fees: ~$3.70

Exposure: Ownership in 12,000+ global companies

Compare this with the 1% annual advisory fee typical of financial advisers. On a $100,000 portfolio, over 30 years, high fees could cost you $112,000 or more in lost returns. That’s a lifetime of missed compounding—potentially a house, college tuition, or years of retirement income.

A.I. & Robotics is Reshaping the Smart Home and Big Tech Wants In

Apple is rolling out Face-ID door locks and robotic smart displays. Elon Musk is quietly building the Tesla Smart Home. A.I. and robotics are driving the next wave of smart home innovation — and the window is open to invest in the companies that can define it.

One category is far bigger than most people realize: window shades. There are billions across homes, offices, and hotels — and almost all of them are still manual.

The last wave created major outcomes. Google bought Nest for $3.2 Billion. Amazon bought Ring for $1.2 Billion. Investors are now hunting for the next category leader — the one that can deliver real exit potential.

RYSE is leading this market with 10 patents, $15 million in revenue, and 200% annual growth. Their a prime acquisition target in a massive, untouched market. And RYSE is pre-IPO with a reserved Nasdaq ticker, giving investors exposure to multiple potential exit paths.

At $2.35 per share, this is your moment to get in before the next wave hits.

Get access to this pre-IPO investment opportunity.

Why This Works Better Than Complex Strategies

Markets reward patience, not cleverness. Every trade costs time, taxes, and opportunity. Studies reveal that missing just the 10 best market days in the last 20 years halves your returns. These best days often follow the worst days—exactly when panic is most likely to drive investors out.

VTI and VXUS eliminate these risks by adhering to three simple steps:

Determine allocation – Example: 70% VTI / 30% VXUS or 80/20 if younger and growth-focused.

Automate contributions – Set a monthly amount to invest, removing emotion from decisions.

Rebalance annually – Ensure allocation remains aligned with your chosen strategy.

The critical part is discipline:

Ignoring panic during market drops (e.g., 30% declines) is the hardest part.

Resisting trends like crypto hype or short-term stock fads is crucial.

Allowing decades of compound growth to accumulate is the ultimate reward.

History proves the S&P 500 has never lost money over any 20-year period, including crises like the Great Depression, dotcom bust, 2008 financial crisis, and COVID crash. With VTI and VXUS, this principle is magnified globally—you’re betting on 12,000 companies worldwide, not just 500 U.S. firms.

Strategic Takeaways for Busy Investors

For the overwhelmed investor, here’s the actionable perspective:

The simplicity advantage:

Two ETFs capture the entire global market, making stock selection unnecessary.

Low fees mean more capital compounds over time, accelerating wealth creation.

Rebalancing and automation remove emotion, a major cause of underperformance.

Key benefits of global exposure:

VTI: Captures U.S. innovation, scale, and economic growth.

VXUS: Protects against U.S.-centric risk, captures dividends, and accesses high-growth international markets.

Portfolio discipline matters more than cleverness:

Patience outweighs market timing.

Avoid overcomplicating investments; simplicity delivers compounding benefits.

Stick to the plan, ignore noise, and let time do the heavy lifting.

Final thought: This strategy isn’t about winning on a single stock or a single hot trend. It’s about building wealth steadily, efficiently, and globally. By committing to VTI and VXUS today, the next 20–30 years can reward you exponentially, turning what seems like “boring index funds” into the backbone of financial independence.

The takeaway for a busy investor: invest smart, keep it simple, automate, and hold. The market will do the work for you.

Ready to Revolutionize Your Wealth?

Here's what's waiting for you:

📈 Step-by-Step Guide: Start Investing in Minutes with Our Chosen Online Broker

🔍 Expert Insights: Uncover the Strategies Behind Our Recommended Smart Portfolios

💼 Easy Diversification: Gain Exposure to a Wide Range of Assets with Just a Few Clicks

💰 Long-Term Growth Potential: Build a Portfolio for Consistent Returns Over Time.

💸 Paying the bills

A.I. & Robotics is Reshaping the Smart Home and Big Tech Wants In

Apple is rolling out Face-ID door locks and robotic smart displays. Elon Musk is quietly building the Tesla Smart Home. A.I. and robotics are driving the next wave of smart home innovation — and the window is open to invest in the companies that can define it.

One category is far bigger than most people realize: window shades. There are billions across homes, offices, and hotels — and almost all of them are still manual.

The last wave created major outcomes. Google bought Nest for $3.2 Billion. Amazon bought Ring for $1.2 Billion. Investors are now hunting for the next category leader — the one that can deliver real exit potential.

RYSE is leading this market with 10 patents, $15 million in revenue, and 200% annual growth. Their a prime acquisition target in a massive, untouched market. And RYSE is pre-IPO with a reserved Nasdaq ticker, giving investors exposure to multiple potential exit paths.

At $2.35 per share, this is your moment to get in before the next wave hits.

Get access to this pre-IPO investment opportunity.

Refind - Brain food is delivered daily. Every day, we analyze thousands of articles and send you only the best, tailored to your interests. Loved by 510,562 curious minds. Subscribe.

TOP MARKET NEWS

Top Market News - January 15, 2026

Best ETFs to Buy for Long-Term Investors

U.S. News Money lists ETFs suitable for long-term portfolios, highlighting diversification, cost-efficiency, and sector allocation considerations.

Tip: Choose ETFs with broad exposure and low fees to maximize long-term growth potential.

Want $1 Million in Retirement? 11 Simple Index Funds Can Help

The Motley Fool outlines a straightforward approach using 11 index funds to build a retirement portfolio capable of reaching $1 million over time.

Tip: Consistency and low-cost investing in broad market funds can significantly accelerate wealth accumulation.

4 Vanguard ETFs That Pay Monthly — Perfect for Steady Retirement Income

247WallSt highlights Vanguard ETFs with monthly distributions, ideal for retirees seeking predictable cash flow alongside portfolio growth.

Tip: Monthly-paying ETFs can supplement retirement income, providing regular cash flow while maintaining market exposure.

BOK Financial Valuation Insights: What Investors Should Know

Yahoo Finance examines BOK Financial’s valuation, profitability, and potential opportunities for investors evaluating the bank’s stock.

Tip: Understanding valuation metrics helps investors make informed decisions about potential entry points and growth expectations.

Advertise with Investing Wise Academy

Elevate your financial brand with targeted exposure to savvy investors and market enthusiasts. Join us early for premium discounts and a compelling story that lands in the right inboxes. Let’s grow together!

Partner with UsPROMO CONTENT

Can email newsletters make money?

With the world becoming increasingly digital, this question will be on the minds of millions of people looking for new income streams in 2025.

The answer is—Absolutely!

That’s it for this episode!

Thank you for taking the time to read today’s email! Your support is what allows me to send out this newsletter for free every day.

What do you think of the new format? Please provide your feedback in the poll below, and if you find the newsletter valuable, feel free to share it with other investors!

How would you rate today's newsletter?

Disclaimer: This newsletter is for informational purposes only and should not be considered financial advice. Please consult with a financial advisor before making any investment decisions.