NIO’s efforts to be above the water…

Check out today’s sponsor. We will not waste your click!

NIO & the EV Market

Alpha Picks is giving away HUGE discounts!

Consider our referral program. You can also earn from $10 or more!

The EV sector is under pressure. This week, Great Wall Motor (02333) fell by 6.59%, Xpeng (09868) fell by 5.3%, Ling Pao Automobile (09863) fell by 4.94%, NIO Inc (09866) fell by 4.29%, and Li Auto Inc (02015) fell by 3.28%.

On the news front, Tesla (TSLA) announced that its second-quarter adjusted earnings per share were $0.52, lower than the market's expected $0.6. Net income was $1.478 billion, lower than the market's expected $1.806 billion. During the period, revenue was $25.5 billion, a year-on-year increase of 2%, while the market expected $24.63 billion. The gross profit margin was 18%, while the market expected 17.4%. The free cash flow (FCF) in the second quarter was $1.34 billion, while the market expected $1.92 billion.

In addition, Trump previously stated that he would end the U.S.'s "mandatory order" of electric cars on his first day in office and emphasized that he would quickly push for the production of electric car assembly lines to return to the U.S. If automakers do not accept this, the U.S. will impose tariffs of around 100% to 200% on each car, making these cars unsellable in the U.S.

The negative price movement of NIO follows EV behemoth Tesla Inc. (NASDAQ:TSLA), which fell sharply in premarket trading, with the pullback coming after the company reported its second-quarter results.

Tesla reported second-quarter earnings per share that trailed expectations. The company expects vehicle production to be sequentially higher in the third quarter but 2024 vehicle growth to be slower than in 2023.

In another development, NIO, the EV behemoth's Chinese electric vehicle rival, is gearing up to introduce NOMI GPT. According to a report from CnEV Post, this virtual AI-powered voice assistant will debut on NIO's second-generation Nio Phone, which launches this Saturday.

Nio's report states that they are integrating AI to enhance user experiences, as revealed by Nio's vice president for hardware, Bai Jian, on Weibo. CnEV Post reported that NIO had been considering launching smartphones for some time and that it was a deliberate decision. Jian highlighted that creating the NIO smartphone was essential for a seamless and integrated experience between NIO vehicles and mobile devices. This strategic approach aims to provide a unique user experience achieved through close integration of the NIO Phone with NIO vehicles. Nio introduced the first-generation Nio Phone during its Nio IN 2023 event on September 21, 2023, priced at RMB6,499.

Today’s sponsor…

Startup PromoTix ($48M in traction) is saving the events industry

Solving high ticket fees and low attendance issues

Offers low-fee, SaaS, and patented marketing tools

Raising funds for expansion; profitable with 656k users

Nio has announced that it will host NIO Innovation Day 2024 on July 27. During this event, Nio plans to introduce the second-generation NIO Phone and officially launch its vehicle operating system, SkyOS, as stated earlier this month, according to CnEV Post.

Price Action: NIO shares are trading lower by 1.79% to $4.40 premarket at last check Thursday.

If you enjoy this newsletter, please consider sharing it with your friends and business contacts by clicking the button below. ⬇

Like everyone else, NIO faces more headwinds. Let’s dig more👇

The electric vehicle (EV) sector faces challenges, with NIO Inc. being one of the companies affected. The China-based EV maker NIO has been reporting losses for some time now. So far this year, the company's stock has dropped by 50.6%, performing worse than the industry average and its competitors like Li Auto and XPeng. With NIO currently trading around 72% lower than its highest price in the past year, should investors see this as a chance to buy?

How is NIO facing the headwinds?

Nio unveiled a new mission and vision to cope with the changing market environment.

The value system upgrade is a response to the changing social and market environment and is based on the understanding of future trends, said Nio.

Nio (NYSE: NIO) has upgraded its corporate mission and vision in response to changing market conditions as well as its own current status.

The electric vehicle (EV) maker today announced value system 3.0, which updates the company's mission and vision.

Nio's updated mission and vision are:

Mission: Blue Sky Coming

Vision: To Build a User Enterprise where Innovative Technology Meets Experience Excellence

By comparison, here is Nio's previous mission as mentioned in its prospectus:

Our mission is to shape a joyful lifestyle by offering premium smart electric vehicles and being the best user enterprise.

In 2015, Nio established its mission to “shape a joyful lifestyle” or value system 1.0 and has been using its “Product + Service + Community” model to serve car owners. In 2020, the company released Value System 2.0.

Over the past few years, the external environment has changed significantly, leading the company to better understand itself and the type of company it aims to become.

The upgrade of the value system is a response to changes in the social and market environment based on Nio's understanding of future trends.

The new energy vehicle (NEV) market is expanding, and user needs are becoming more diverse. As a result, technology and experience will be critical elements of business competition. Nio has updated its mission and vision to provide a more clearly defined strategic direction. The company is committed to becoming a user enterprise that leads in technology and experience to create a sustainable and better future. Before the announcement of the updated mission and vision, Nio founder, chairman, and CEO William Li had already explained the thinking behind it to employees in an all-hands meeting on July 19. William Li mentioned that with today's changing landscape, the original words no longer fully reflect the company's mission. He added that, with a multi-brand, globalized operation, Nio needs a new shared mission, vision, drivers, and values.

With its new mission and vision, Nio continues to use the same five enablers as before:

Put User Interest First

Experiences Beyond Expectations

Continuous Innovation

System Efficiency

Deiven by Design

Each of the five enablers is actionable, said Li. “All work must create value for users from the perspective of their interests, and behavior that harms their interests will not be tolerated,” he said.

In addition, he emphasized four values:

Honestly

Care

Vision

Action

Li said that Nio's values have remained unchanged since its establishment, and they are the foundation and main line of Nio.

This value system upgrade has constructed a basic framework for the market competition, multi-brand operation, and globalization layout that has come and is about to come, said Li.

“We believe that such a system can make us a better company and can make us a more successful company”, he said.

YTD Price Performance

Image Source: Zacks Investment Research

What’s Behind NIO’s Dismal Run on the Bourses?

The decrease in stock prices results from the broader difficulties in the electric vehicle (EV) market. NIO's first-quarter deliveries dropped by 40% due to slower EV adoption. In the fiercely competitive Chinese EV market, NIO has been compelled to reduce prices and provide substantial incentives to increase sales. Consequently, NIO's profit margins decreased to 9.2% in the first quarter of 2024, a sequential decline of 270 basis points, resulting in a larger-than-expected loss. In addition, NIO is encountering challenges in the international trade arena as the European Commission has imposed additional duties of up to 38% on Chinese EVs. While this may exacerbate NIO's difficulties, the impact is likely to be limited as only a small proportion of NIO's sales come from outside China.

Evaluating the Stock’s Potential Upside

Investors should take note that NIO began upgrading its models last year. With the completion of the upgrades, the company’s deliveries have started to increase again. In the second quarter of 2024, NIO's deliveries went up by 144% year over year to 57,373 units. In April, the company started delivering its upgraded ET7 model. NIO has a strong product lineup, including models such as the ES6, ET5T, ES8, EC6, EL7, ET5, ET7, and EC7, which is likely to boost NIO’s deliveries.

In May 2024, NIO launched ONVO, a new brand targeting the mainstream family market. L60, ONVO’s first product, is set for launch in September 2024. This move is expected to expand NIO’s market reach and enhance its scale, with the company aiming for a vehicle margin above 15% for the ONVO brand in the long run.

NIO’s acquisition of two JAC plants is expected to reduce production costs, thus improving efficiency and competitiveness. As NIO increases production of its 2024 models and implements cost control measures, it projects a rebound in its vehicle margins, expecting a return to double-digit margins in the second quarter of 2024 and a further improvement in the latter half of the year.

NIO’s battery swap technology, part of NIO’s battery as a service (BaaS) strategy, gives the firm an advantage over its peers. In its first-quarter 2024 earnings call, NIO reported that it had installed 2,472 power swap stations worldwide. Encouragingly, NIO aims to build more than 1,000 new battery swap stations in 2024, which bodes well for its top-line growth.

Even from a valuation perspective, NIO's price-to-sales (P/S) ratio is currently lower than historical highs. NIO is trading at a forward sales multiple of 0.61, which is lower than its 5-year median of 2.04. The stock also remains attractively valued compared to its close peers like LI and XPEV.

Valuation

Image Source: Zacks Investment Research

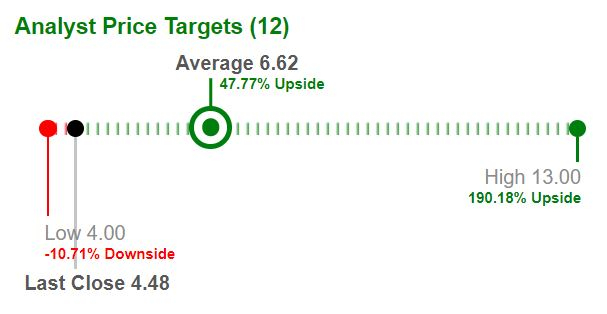

The Zacks average price target for NIO is $6.62 per share, indicating a potential upside of nearly 48% from the current level.

Image Source: Zacks Investment Research

The company is making commendable efforts to revitalize its product line, expand its market reach, and innovate with its battery technology. While existing shareholders should retain the stock, potential investors shouldn’t overlook the headwinds surrounding the company. The company is projected to remain unprofitable in the foreseeable future, with the Zacks Consensus Estimate for 2024 loss per share widening to $1.41. The consensus mark for 2025 loss per share is pegged at $1. Additionally, NIO may need to raise cash through dilutive means, which could negatively impact the stock. Investors should also be cautious of NIO’s volatility and the sentiment surrounding Chinese American Depository Receipts (ADRs), which remains pessimistic. The EV sector, in general, is still grappling with mixed sentiments and market uncertainties, making NIO a riskier proposition for short-term investors. Only those with a higher risk tolerance and a long-term investment horizon should consider buying NIO shares now."

NIO currently carries a Zacks Rank #3 (Hold).

Sources:

Moomoo news, Zacks, CNBC

That’s it for this episode!

Is this a buying opportunity or a time to sell? Share your thoughts in the comment section below.

Remember: Investing is a journey, not a destination. It's about making informed decisions, managing risk, and staying committed to your long-term goals. So, take the time to research, experiment, and find the perfect recipe for your balanced portfolio.

If you want to learn and strengthen your investment portfolio, we have 9 steps to help you avoid an investment meltdown. Check out the 9-part series here. 👇

Cheers to wealth, wisdom, and a dash of madness!

The Investing Wise Academy Team

Disclaimer: This newsletter is for informational purposes only and should not be considered financial advice. Please consult with a financial advisor before making any investment decisions.

P.S. Don't forget to share this newsletter with your friends and colleagues who are also interested in investing in the future of finance!

Paying the bills

Our newsletter is powered by #beehiiv, which partners with trustworthy and high-quality advertisers. We receive payment from the advertisers for each verified click. By clicking to explore the products or services being promoted, you may find something valuable. When you click, not only do you have the opportunity to benefit from the ads, but you also help support our efforts to improve our newsletter for you as our readers or listeners. All profits are reinvested into growing our newsletter to provide more excellent value to you. Your genuine engagement with the ads would mean a lot to us.

Today’s sponsors…

Startup PromoTix ($48M in traction) is saving the events industry

Solving high ticket fees and low attendance issues

Offers low-fee, SaaS, and patented marketing tools

Raising funds for expansion; profitable with 656k users