Welcome, {{ survey_name | Investors }}!

The market is buzzing with earnings season, Jerome Powell’s comments, and AI hype. But with all this noise, it’s about focusing on what really matters.

Here’s how I’m navigating the chaos:

📈 Palantir: Hype or the Real Deal?

Palantir ($PLTR) has surged 425% this year, thanks to AI and gov contracts. But with a price-to-sales ratio near 100, any slip-up could lead to big losses. The narrative’s exciting, but watch the numbers.

🎢 Disney: At a Crossroads

Disney ($DIS) is struggling with Disney+ growth, but its parks and sports networks offer strong cash flow. It’s undervalued, but it needs to adapt to the digital age. Can it evolve? We’ll see.

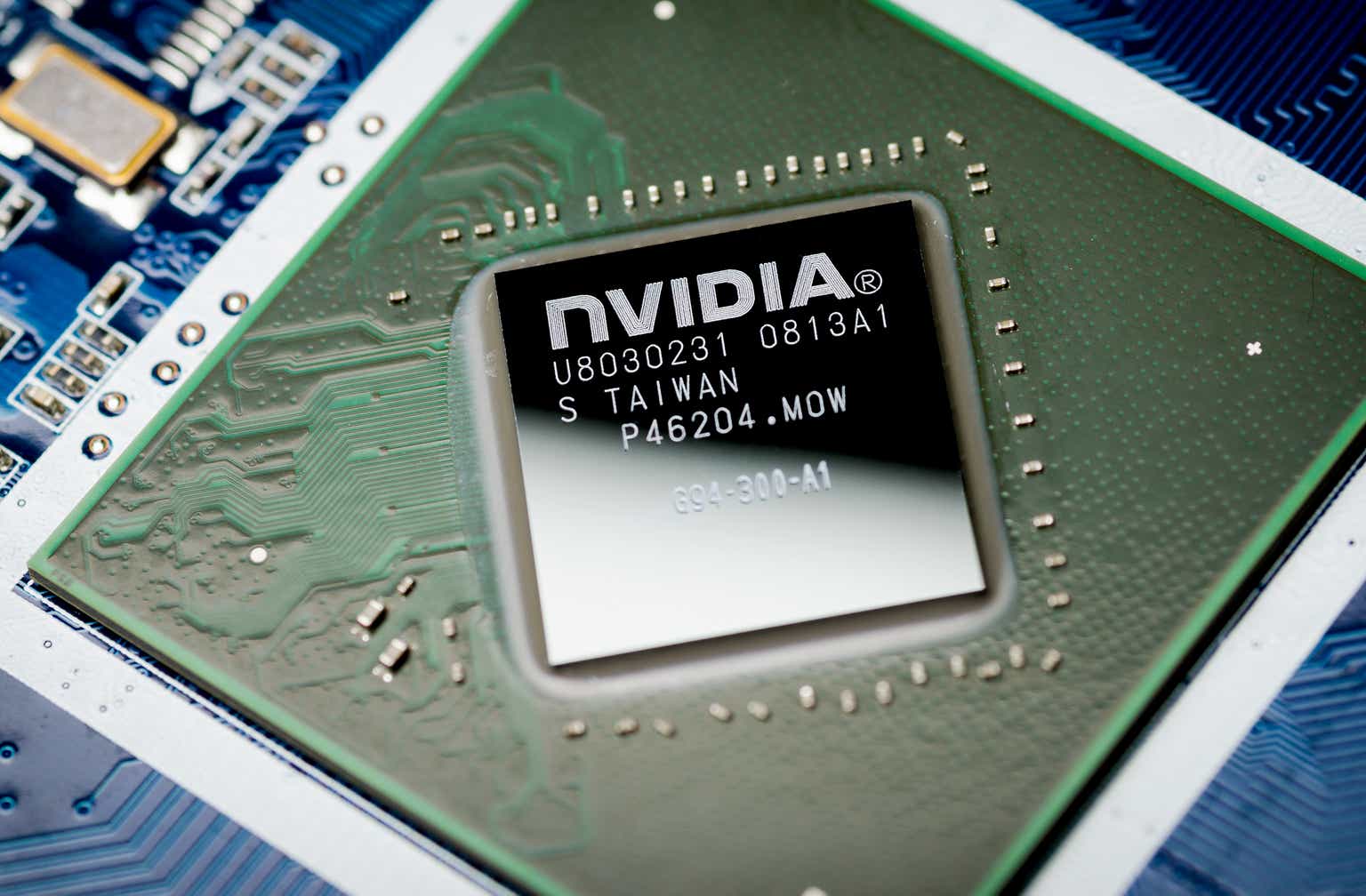

💻 AMD: Battling Nvidia in AI

AMD ($AMD) is competing in the hot AI space, but Nvidia still leads. The next earnings call will be pivotal to show if AMD can close the gap and challenge the competition.

🏛️ The Fed: The Ultimate Market Mover

Powell’s next move on interest rates could determine the market’s direction. If he hints at a rate cut, expect a tech rally. If he stays hawkish, volatility could increase. Pay attention to his language.

⚖️ What to Watch:

Beyond Palantir, Disney, and AMD, earnings from Uber, ConocoPhillips, and Shopify will provide key insights into consumer behavior and inflation. Focus on the signals, not the noise.

Want more tips and a free portfolio guide to make smarter moves? Join my newsletter for exclusive content and actionable insights. Let’s build wealth together! 📈🚀

Erwin Dwight

Founder of Investing Wise Academy

FREE CONTENT

$PLTR, $DIS, $AMD: Explosive Earnings & Fed Clues to Skyrocket Wealth

Buckle up for a crucial week in the stock market, where opportunity clashes with uncertainty. Palantir $PLTR ( ▼ 4.83% ), Disney $DIS ( ▼ 5.31% ), and AMD $AMD ( ▼ 3.58% ) are set to unveil earnings that could either cement their bullish runs or expose cracks in their . . .

SPONSOR

Plus, $269/year + 7-day free trial + next Alpha Pick FREE with our Spring Sale! Don't miss out – Start Investing Smarter today!

Navigating Premium: Key Features + New AI-Powered Tools

Seeking Alpha's Premium subscription offers homepage customization to focus your investment strategies, leverage AI functionalities, and comparison features to analyze stock performance. Enjoy enhanced features for your investment needs today.

FEATURED CONTENT

Analyst who bought Palantir stock before a 600% rally updates price target

The artificial intelligence boom has been a game-changer, helping many tech stocks, including Palantir Technologies, deliver mouth-watering returns. While the S&P 500's 24% return in 2024 is impressive, it pales compared to the 340% return for Palantir's shares. More amazing, while the S&P 500 has slumped 3% in 2025, Palantir's stock price is up …

TOP MARKET NEWS

TRENDING STOCKS

Top Gainers

Date (NY Time): 03:42 Monday, May 5, 2025 (EDT)

- ELRE - Yinfu Gold Corp - Chart & Analysis from Stocktwits

- FRGT - Freight Techn ... - Chart & Analysis from Stocktwits

- CIFS - China Interne ... - Chart & Analysis from Stocktwits

Disclaimer: This information is for educational purposes only. Trading involves risk. Please do your own research. Stocktwits discussions are user-generated and may not reflect accurate financial analysis.

PREMIUM CONTENT

Get the blueprint to build a winning portfolio today!

Get hold of a profitable portfolio and learn how to trade effortlessly! Applovin and Sea Ltd's stocks demonstrate that this portfolio is already profitable…

PROMO CONTENT

Can email newsletters make money?

With the world becoming increasingly digital, this question will be on the minds of millions of people looking for new income streams in 2025.

The answer is—Absolutely!

That’s it for this episode!

Thank you for taking the time to read today’s email! Your support is what allows me to send out this newsletter for free every day.

What do you think of the new format? Please provide your feedback in the poll below, and if you find the newsletter valuable, feel free to share it with other investors!

How would you rate today's newsletter?

Disclaimer: This newsletter is for informational purposes only and should not be considered financial advice. Please consult with a financial advisor before making any investment decisions.