Tesla Earnings Reaction - BUY, SELL or HOLD?

Alpha Picks is giving away HUGE discounts!

Consider our referral program. You can also earn from $10 or more!

Join the POLL here ⬇

July 24, 2024 - $Tesla (TSLA.US)$shares dropped 7.93% to $226.83 in pre-market trading on Wednesday, and it closed at $215.99

The company has reported its financial results for the second quarter of 2024 after the market closes on Tuesday, July 23, 2024.

Financial Highlights

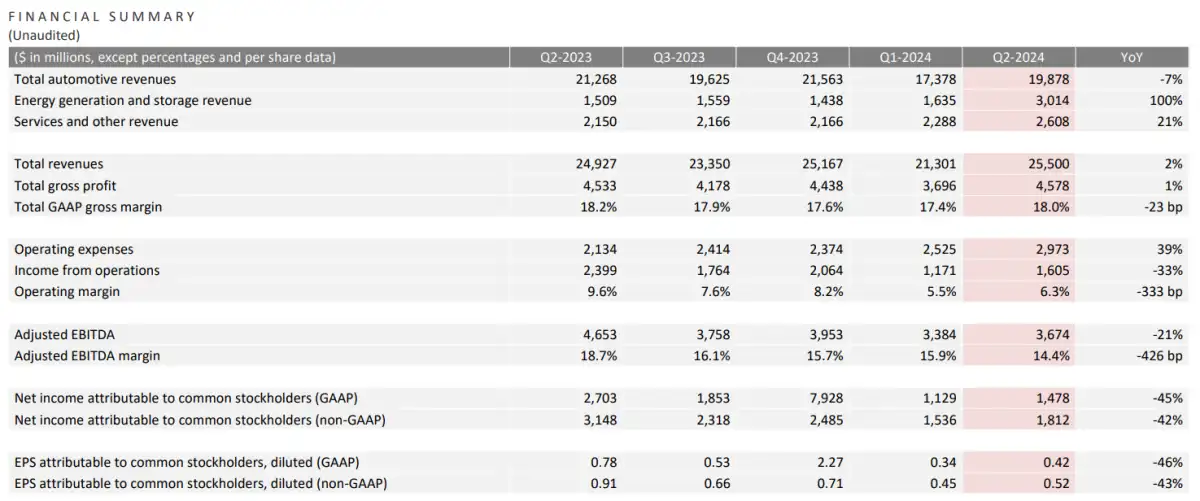

Revenue reached $25.5 billion, versus the $24.54 billion analysts expected.

Adjusted earnings totaled $0.52 per share, Analysts had forecast $0.61per share.

Operating income reached $1.60 billion, which marks a decline of 33% year-over-year.

Net earnings were reported at $1.81 billion, indicating a substantial year-over-year drop of 42%.

Tesla has not provided a new full-year sales target, but it warned that "in 2024, the growth rate of our vehicle fleet could be significantly lower than that of 2023." Tesla's profitability has taken a hit due to declining sales and reduced payments by buyers for its core models. Musk partially attributed the underperformance to a price war that erupted last year when competitors launched their own electric vehicles. During a call with analysts, Musk stated, "There are quite a few competitors' cars hitting the market, but they are not performing well; however, there are substantial discounts on these vehicles."

Musk confirmed that the launch of Robotaxi has been postponed to October 10th. In its financial report, Tesla indicated that it still faces regulatory and technological hurdles before it can offer driverless robotaxi services. Musk expressed optimism that Tesla's autonomous driving would receive regulatory approval and stated that he would be "shocked" if the first Robotaxi ride did not happen next year, but he could not provide a definitive timeline.

That’s it for this episode!

Is this a buying opportunity or a time to sell? Share your thoughts in the comment section below.

Remember: Investing is a journey, not a destination. It's about making informed decisions, managing risk, and staying committed to your long-term goals. So, take the time to research, experiment, and find the perfect recipe for your balanced portfolio.

If you want to learn and strengthen your investment portfolio, we have 9 steps to help you avoid an investment meltdown. Check out the 9-part series here. 👇

Cheers to wealth, wisdom, and a dash of madness!

The Investing Wise Academy Team

Disclaimer: This newsletter is for informational purposes only and should not be considered financial advice. Please consult with a financial advisor before making any investment decisions.

P.S. Don't forget to share this newsletter with your friends and colleagues who are also interested in investing in the future of finance!

Paying the bills

Our newsletter is powered by #beehiiv, which partners with trustworthy and high-quality advertisers. We receive payment from the advertisers for each verified click. By clicking to explore the products or services being promoted, you may find something valuable. When you click, not only do you have the opportunity to benefit from the ads, but you also help support our efforts to improve our newsletter for you as our readers or listeners. All profits are reinvested into growing our newsletter to provide more excellent value to you. Your genuine engagement with the ads would mean a lot to us.