Today’s episode - Hacking Your Investment

Which investment theme sparks your interest the most?

- Artificial Revolution: Explore the potential of AI and robotics.

- Gaming Industry: Tap into the explosive growth of gaming and esports.

- Public Utility Stocks: Invest in essential services with stable returns.

- Renewable Energy: Support a greener future and profit from sustainable solutions.

- Leading Fashion Stocks: Discover opportunities in the dynamic world of fashion and apparel.

- Others (Please comment it)

Please support our sponsor. They provide valuable information for you and me.

If you enjoy this newsletter, please consider sharing it with your friends and business contacts by clicking the button below. ⬇

Good Morning! 💹

High-profile hacks, AI advancements, and government spending are igniting the cybersecurity sector. But amidst the frenzy, are these stocks a golden opportunity or a ticking time bomb? Dive in as we dissect the market, analyze top players, and reveal expert insights to help you navigate this thrilling investment landscape.

Are you new to investing? Are you overwhelmed by choices? Too busy to manage your money? Unlock the secrets to smart investing with our premium newsletter.

Let's take note of this well-constructed portfolio focused on the gaming industry, comprising 31 strong stocks. The year-to-date gain is +29.47%. If you had invested in these 31 solid stocks five years ago, the gain would be +244.79%, with an annualized return of +25.78%.

One of the assets in this portfolio is Applovin Corp ($APP), which has grown 77.02% in the past six months. Take a look at the chart below:

Disclaimer: This newsletter is for informational purposes only and should not be considered financial advice. Please consult with a financial advisor before making any investment decisions.

If gaming-related stocks are not suitable for you, how about a technology-packed portfolio focusing on cybersecurity?

Paying the bills

Our newsletter is powered by beehiiv, which partners with trustworthy and high-quality advertisers. When you click, not only do you have the opportunity to benefit from the ads, but you also help support our efforts to improve our newsletter for you as our readers or listeners. All profits are reinvested into growing our newsletter to provide more excellent value. Your genuine engagement with the ads would mean a lot to us.

🦾 Master AI & ChatGPT for FREE in just 3 hours 🤯

1 Million+ people have attended, and are RAVING about this AI Workshop.

Don’t believe us? Attend it for free and see it for yourself.

Highly Recommended: 🚀

Join this 3-hour Power-Packed Masterclass worth $399 for absolutely free and learn 20+ AI tools to become 10x better & faster at what you do

🗓️ Tomorrow | ⏱️ 10 AM EST

In this Masterclass, you’ll learn how to:

🚀 Do quick excel analysis & make AI-powered PPTs

🚀 Build your own personal AI assistant to save 10+ hours

🚀 Become an expert at prompting & learn 20+ AI tools

🚀 Research faster & make your life a lot simpler & more…

Please support our partners.

Refind - Brain food is delivered daily. Every day we analyze thousands of articles and send you only the best, tailored to your interests. Loved by 510,562 curious minds. Subscribe.

Thoughts on the Rising Tide in Cybersecurity & Key Stock Insights

In the wake of a series of high-profile cyberattacks and the growing buzz around artificial intelligence (AI), investor interest in cybersecurity stocks is reaching a fever pitch. This heightened attention, coupled with anticipated federal government spending on cybersecurity in 2024, has many wondering if now is the opportune time to invest in this sector.

Market Outlook and Growth Drivers

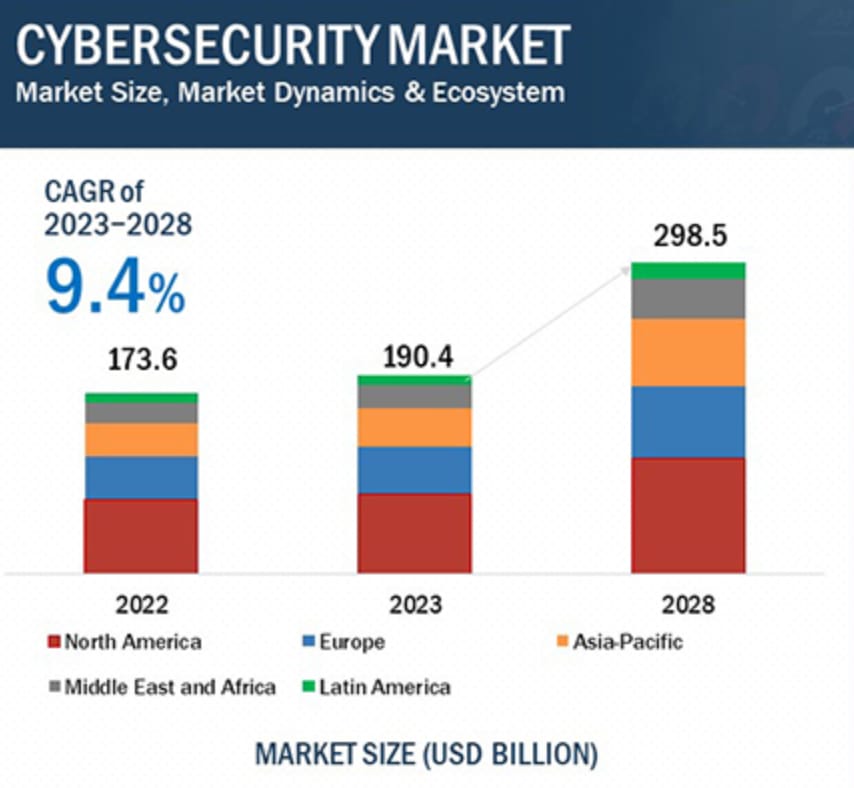

The cybersecurity market is poised for significant growth in the coming years. According to a report by MarketsandMarkets, the market is expected to grow from $190.4 billion in 2023 to $298.5 billion by 2028, representing a compound annual growth rate (CAGR) of 12.0%. Several factors fuel this growth:

The increasing number and sophistication of cyberattacks are driven in part by hackers' use of AI.

Growing awareness of cybersecurity threats and the potential financial and reputational damage they can cause.

The increasing adoption of digital technologies expands the attack surface for cybercriminals.

Stringent government regulations mandating cybersecurity measures for businesses and organizations.

The rising demand for cloud-based security solutions as more companies migrate their data and operations to the cloud.

Key Market Segments and Trends

Identity and Access Management (IAM): This segment, which focuses on controlling user access to systems and data, is expected to be the largest segment of the cybersecurity market, with a market share of 22.8% in 2028.

Network Security: Protecting networks and data from unauthorized access and attacks, this segment is projected to be the second-largest, with a market share of 21.5% in 2028.

Cloud Security: As cloud adoption accelerates, the demand for cloud-based security solutions is surging. This segment is expected to be the fastest-growing, with a CAGR of 14.8%.

AI-Powered Security: AI is being integrated into cybersecurity solutions to enhance threat detection, response, and automation capabilities.

The AI-Cybersecurity Nexus

AI's transformative power is undeniable, impacting numerous industries, including cybersecurity. While AI-powered tools offer cybersecurity firms the ability to detect and respond to threats faster and more efficiently, they also present a double-edged sword. Hackers are increasingly leveraging AI to launch more sophisticated and damaging attacks. This dynamic is driving a surge in demand for advanced cybersecurity solutions to counter AI-driven threats.

Market Leaders, Emerging Players, and Stock Insights

Palo Alto Networks (PANW): A leader in cloud security and AI-powered solutions, Palo Alto is well-positioned for continued growth. Its platformization strategy and focus on consolidation could further strengthen its market position. Stock Performance: Up 48.84% YTD, currently trading at $340.12.

CrowdStrike (CRWD): Despite recent challenges, CrowdStrike remains a significant player in the endpoint and cloud security markets. Investors may want to monitor its upcoming investor day for insights into its plans and growth potential. Stock Performance: Up 84.44% YTD, currently trading at $299.85.

Fortinet (FTNT): While facing competition from cloud-based solutions, Fortinet's strong presence in the firewall market and expansion into SD-WANs offer potential opportunities. Stock Performance: Up 31.83% YTD, currently trading at $76.78.

CyberArk Software (CYBR): As the demand for privileged access management solutions grows, investors could continue to show interest in CyberArk. Stock Performance: Up 67.36% YTD, currently trading at $280.62.

Emerging Startups: While investing in startups carries higher risks, companies like Wiz, Snyk, and Lacework represent potential high-growth opportunities for those willing to take on more risk.

Authors Insights

As cyberattacks continue to increase in frequency and sophistication, the importance of robust cybersecurity measures cannot be overstated. The combination of increased federal government spending, the growing adoption of AI, and a wave of innovative startups is creating a fertile ground for growth in the cybersecurity sector.

Investors who take the time to understand the market and identify companies with solid fundamentals and promising technologies are well-positioned to reap the rewards of this burgeoning industry. However, as with any investment, due diligence is crucial. It's essential to carefully evaluate potential risks and rewards before making investment decisions.

Final Thoughts

The cybersecurity market presents a compelling investment opportunity driven by the increasing prevalence of cyberattacks, the growing adoption of digital technologies, and the transformative power of AI. With a projected CAGR of 12.0% from 2023 to 2028, the market is poised for significant growth.

Investors willing to research and carefully evaluate potential risks and rewards can position themselves to benefit from this burgeoning industry. By staying informed about market trends, emerging technologies, and individual company performance, investors can make informed decisions and potentially reap the rewards of the cybersecurity boom.

Refind - Brain food is delivered daily. Every day we analyze thousands of articles and send you only the best, tailored to your interests. Loved by 510,562 curious minds. Subscribe.

The information presented here is for informational purposes only and should not be construed as financial advice. Always consult with a qualified financial advisor before making any investment decisions.

Thank you for reading this far. Let us share our Top Cybersecurity Portfolio with you—it’s FREE!

After reviewing today's FREE Cybersecurity Stocks list, consider exploring our Premium content for access to our portfolio, designed to help you reach your investment goals.

That’s it for this episode!

Thank you so much for reading today’s email! Your support is the only way I can write this email for free daily.

Kindly give us feedback in the poll below and share the newsletter with other investors if you find it valuable!

How would you rate today's newsletter?

Remember: Investing is a journey, not a destination. It's about making informed decisions, managing risk, and staying committed to your long-term goals. So, take the time to research, experiment, and find the perfect recipe for your balanced portfolio.

Cheers to wealth, wisdom, and a dash of madness!

The Investing Wise Academy Team

Disclaimer: This newsletter is for informational purposes only and should not be considered financial advice. Please consult with a financial advisor before making any investment decisions.

Caught Our Eye

NIO Stock - Prediction: This Will Be Nio's Next Big Move

Palantir Stock - Palantir and Dell Are Set to Join the S&P 500 on Monday. Here's What That Means.

Microsoft has agreed to purchase all the power from a reopened Three Mile Island nuclear plant for 20 years. The plant, which will reopen by 2028 at a cost of $1.6 billion, will generate 835 megawatts of power for Microsoft. This unprecedented deal requires approval from regulators, including safety inspections from the Nuclear Regulatory Commission.

Recent data shows increasing uncertainty and financial stress among American consumers. About one-third of consumers do not expect their real income to increase in the next five years, and people feel less likely to retire comfortably compared to five years ago. Since 2019, the Consumer Price Index (CPI) has risen by over 20%, leading to a higher cost of living. Higher borrowing costs and concerns about job security have collectively reduced Americans' optimism about their financial situations.