Market drawdowns often punish uncertainty, not broken businesses—and healthcare absorbs that fear first. Policy shifts, utilization spikes, and regulatory noise have pushed even resilient insurers into uncomfortable territory. Oscar Health and UnitedHealth sit at opposite ends of the spectrum, yet both are being repriced as if disruption were permanent. For long-term investors, these moments are less about timing bottoms and more about understanding who prepared for volatility. When clarity returns, it is usually discipline—not optimism—that gets rewarded.

The final section of this newsletter explains how to position when fear peaks—and why discipline matters more than timing.

Let’s embark on this transformative journey together and position your portfolio for success in this evolving market landscape!

Be sure to read through to the end to catch all the valuable insights this newsletter delivers to your inbox today.

JNJ's Steady Care: $500 Monthly Bets Could Heal Your Portfolio in Five Years

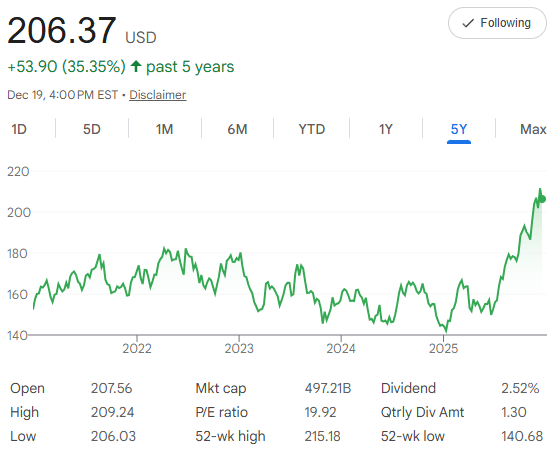

Five years ago, Johnson & Johnson $JNJ ( ▲ 1.53% ) shares were trading around $152.47 each. Today, December 19, 2025, it's closed at $206.37—a calm 35.35% gain that comes from its trusted spot in healthcare, with strong sales in medicines, medical devices, and everyday products like Band-Aid and Tylenol. The chart shows a stable path with some ups and downs over the years, ending with a nice lift in 2025, and after-hours at $207.15. That 52-week high of $215.18 shows there's still room for more steady progress. In simple terms, the compound annual growth rate (CAGR) is 6.25%. That's the average yearly growth that added up—calculated by raising the total growth factor to the 1/5 power and subtracting 1. It means growing your money by about 6% each year, on average.

Dollar-cost averaging (DCA) works well here: Invest $500 every month for five years, totaling $30,000. You buy more shares on lower days and fewer on higher ones, which helps even out the bumps. Projecting at the same historical pace, with a monthly growth rate of about 0.51% from $206.37, your shares grow slowly but surely.

After 60 months, your total could reach $34,512. That's a gain of $4,512—a 15% return on your investment. The early buys get the most from compounding, while later ones still add to the health of your portfolio. This is based on the past, which isn't a promise for the future—healthcare can face lawsuits or competition, but a P/E ratio of 19.92 shows reasonable pricing, and a solid 2.52% dividend yield gives regular income. With that 52-week high of $215.18 in reach and a $497.21B market cap, JNJ offers reliable care.

If DCA fits your patient style, it could turn your $500 habit into a comfortable cushion by 2030. Feel secure?

📉🏥Buying When Conviction Is Uncomfortable

Sharp drawdowns rarely signal broken businesses. More often, they signal policy ambiguity, temporary margin pressure, and investor impatience. Healthcare, more than most sectors, absorbs these shocks first—because it sits at the intersection of regulation, demographics, and cost inflation.

Right now, two healthcare names are being repriced aggressively, not because demand is declining, but because the system around them is in flux. Coverage rules are debated. Subsidies are questioned. Utilization has spiked. Headlines are loud.

For the investor who doesn’t have time to monitor every legislative development, this moment requires a different filter:

Is the business model adaptable when the rules shift?

Is management planning for disruption—or reacting to it?

This distinction separates temporary drawdowns from structural breakdowns.

Oscar Health and UnitedHealth sit on opposite ends of the size and maturity spectrum, yet both reflect the same market behavior: pricing fear first, clarity later. Historically, this is where long-term capital begins to work—quietly, without urgency.

Oscar Health: A Scaled Revenue Engine Priced Like a Fragile Startup

Oscar Health’s $OSCR ( ▲ 0.81% ) valuation disconnect begins with a simple mismatch: scale without profitability—yet.

With a market capitalization near $4 billion and expected annual revenue approaching $12 billion, the company trades well below a 1x price-to-sales ratio. In isolation, this appears irrational. In context, it reflects skepticism around margins, regulatory exposure, and historical volatility.

Oscar operates predominantly within the ACA individual marketplace, making it sensitive to the expiration of enhanced subsidies. Those subsidies are expected to lapse, not the ACA itself—a crucial distinction often lost in headline risk.

Rather than wait for clarity, Oscar has already acted:

• 2026 pricing assumes subsidies expire, incorporating a 28% weighted-average rate increase

• $60 million in administrative cost reductions are being implemented

• Capital allocation has been defensive, preserving liquidity

• Competitor retreat is expected—and planned for

Management is effectively betting that survival during contraction creates opportunity during consolidation.

The long-term opportunity remains substantial. The individual insurance market is projected to expand materially over the next decade, potentially covering up to 120 million Americans, including gig workers, small businesses, part-time employees, and segments traditionally underserved by employer-sponsored plans.

Oscar’s technology-first model—particularly its use of AI for claims processing, member engagement, and utilization management—allows it to operate with a lower cost structure than legacy insurers. In an environment where margins matter more than growth, efficiency becomes leverage.

The Risk Oscar Bears—and Why It’s Being Understood, Not Ignored

Oscar’s risk profile is real and measurable.

Medical Loss Ratio climbed to 88.5%, up 380 basis points year-over-year, reflecting rising utilization and healthcare inflation. Risk adjustment payments for 2025 increased by approximately $130 million, exposing the company to adverse risk pool shifts if healthier members exit the system.

These are not theoretical risks. They are happening.

What matters is response.

Despite margin pressure, revenue grew 23% year-over-year, while membership increased 28%, signaling demand resilience. Importantly, SG&A declined to 17.5%, moving closer to the company’s long-term target of ~16%. Revenue growth continues to outpace overhead.

Oscar also holds over $1 billion in excess capital and has been actively cleaning up debt—critical for navigating policy-driven volatility.

The bull case does not rely on perfect conditions. It relies on outlasting less efficient competitors during a turbulent period and emerging with greater share when the market stabilizes. The bear case assumes cost inflation overwhelms efficiency gains faster than pricing power can adjust.

This is asymmetrical by design: uncomfortable in the short term, potentially transformational if execution continues.

UnitedHealth: When Scale Absorbs the Shock

UnitedHealth’s $UNH ( ▲ 1.96% ) drawdown tells a different story—one of reset, not retreat.

Valued around $300 billion, UnitedHealth has been pressured by Medicare reimbursement cuts, elevated utilization, and margin compression within Optum. The stock declined sharply, at one point trading near $240, reflecting fears of sustained profitability erosion.

Yet structurally, UnitedHealth is far less exposed to ACA volatility than smaller peers. The majority of its $57 billion in individual and employer revenues originate from corporate-sponsored plans, insulating it from subsidy-driven disruption.

Management has been explicit: 2026 is a reset year.

• Medicare Advantage enrollment will contract by ~1 million members

• ACA exposure will be reduced

• Short-term earnings are sacrificed to restore margin integrity

• Earnings growth is expected to resume in 2026

• Double-digit EPS growth projected for 2027

Commercial insurance margins are expected to normalize between 7–9%, restoring a profitability profile consistent with UnitedHealth’s historical strength.

Political rhetoric around affordability introduces headline risk but rarely dismantles diversified incumbents. UnitedHealth’s scale, lobbying power, and operational depth allow it to absorb regulatory pressure far more effectively than smaller players.

This is not a growth story. It is a valuation repair anchored in durability.

Two Paths Through the Same Uncertainty

Oscar Health and UnitedHealth represent two responses to the same environment:

• One survives through agility and efficiency

• The other endures through scale and diversification

Oscar offers asymmetrical upside, tied to execution, market consolidation, and a growing individual insurance ecosystem. UnitedHealth offers stability and recovery, priced as if disruption were permanent rather than cyclical.

Neither depends on optimism. Both depend on discipline.

For investors with limited time and high cognitive load, the takeaway is not to choose sides emotionally—but to recognize what kind of uncertainty is being priced in.

Markets routinely over-discount discomfort. When clarity returns—as it always does—capital tends to flow back toward businesses that prepared rather than panicked.

This is not about timing the bottom. It is about understanding which companies planned for disruption before it arrived—and positioning accordingly.

Ready to Revolutionize Your Wealth?

Here's what's waiting for you:

📈 Step-by-Step Guide: Start Investing in Minutes with Our Chosen Online Broker

🔍 Expert Insights: Uncover the Strategies Behind Our Recommended Smart Portfolios

💼 Easy Diversification: Gain Exposure to a Wide Range of Assets with Just a Few Clicks

💰 Long-Term Growth Potential: Build a Portfolio for Consistent Returns Over Time.

💸 Paying the bills

Refind - Brain food is delivered daily. Every day, we analyze thousands of articles and send you only the best, tailored to your interests. Loved by 510,562 curious minds. Subscribe.

The best trades require thorough research, followed by a commitment.

TOP MARKET NEWS

Top Market News - December 23, 2025

Buying 3 Perfect ETFs Could Make You a Millionaire

Building a million-dollar portfolio doesn't require picking individual stocks. By focusing on three "perfect" ETFs—covering the broad S&P 500 for stability, the Nasdaq-100 for high-octane growth, and a dividend-focused fund for passive income—investors can harness the power of compounding while minimizing risk through automatic diversification.

Tip: Consistency is key. Automate your monthly contributions to these three funds to ensure you're buying in all market conditions, allowing time and growth to do the heavy lifting.

A $500K Retirement Portfolio That Pays 7% Yearly

Retiring comfortably with a $500,000 portfolio is achievable by targeting a 7% annual yield. By strategically selecting high-yield assets such as Real Estate Investment Trusts (REITs), Business Development Companies (BDCs), and specialized income funds, retirees can generate approximately $35,000 in annual income to supplement Social Security.

Tip: Focus on "yield on cost." Reinvesting dividends during your working years can significantly inflate your eventual payout, making a 7% target even more sustainable in retirement.

Hedge Funds and Banks Drive Growth in Crypto ETF Trading

The landscape of digital assets is shifting as institutional heavyweights like hedge funds and major banks ramp up their activity in crypto ETFs. This institutional adoption provides a layer of liquidity and legitimacy to the market, signaling a move away from retail-driven volatility toward a more structured, professionalized trading environment.

Tip: Follow the "Smart Money." Growing institutional interest often precedes long-term price stability; consider a small, disciplined allocation to crypto ETFs as part of a diversified growth strategy.

Understanding Warren Buffett's 90/10 Retirement Rule

Warren Buffett’s famous 90/10 rule offers a masterclass in simplicity: invest 90% of your capital in a low-cost S&P 500 index fund and 10% in short-term government bonds. This strategy aims to outperform most actively managed portfolios by keeping fees low and maintaining enough liquidity to weather short-term market dips.

Tip: Simplicity often beats complexity. If you're overwhelmed by market noise, the 90/10 rule provides a battle-tested framework that prioritizes long-term American corporate growth.

Advertise with Investing Wise Academy

Elevate your financial brand with targeted exposure to savvy investors and market enthusiasts. Join us early for premium discounts and a compelling story that lands in the right inboxes. Let’s grow together!

Partner with UsPROMO CONTENT

Can email newsletters make money?

With the world becoming increasingly digital, this question will be on the minds of millions of people looking for new income streams in 2025.

The answer is—Absolutely!

That’s it for this episode!

Thank you for taking the time to read today’s email! Your support is what allows me to send out this newsletter for free every day.

What do you think of the new format? Please provide your feedback in the poll below, and if you find the newsletter valuable, feel free to share it with other investors!

How would you rate today's newsletter?

Disclaimer: This newsletter is for informational purposes only and should not be considered financial advice. Please consult with a financial advisor before making any investment decisions.