Every major investment cycle has a phase where the biggest opportunity doesn’t look like one—yet. Today, that moment is unfolding quietly inside companies still labeled as “Bitcoin miners.” Beneath the volatility and outdated narratives sits something far more valuable: energy-dense, power-secured infrastructure that AI now desperately needs. As artificial intelligence shifts from a software story to a physical one—defined by electricity, land, cooling, and scale—the market is slowly recognizing that these problems were solved years ago.

In the full newsletter, we break down which names offer pure optionality, which are executing today, and which one shows what a successful re-rating looks like when the market finally changes the label.

Let’s embark on this transformative journey together and position your portfolio for success in this evolving market landscape!

Be sure to read through to the end to catch all the valuable insights this newsletter delivers to your inbox today.

Presented By MarketBeat

The Only Insurance That Can Make You Richer

Most insurance costs you money.

But there’s a kind that can pay you when the stock market drops.

One example turned $200 into $2,000 during a downturn.

And you don’t even need to own stock to use it!

It protects your portfolio and can generate profits when stocks fall.

You’ll find the step-by-step breakdown in this free guide.

It's simple, fast to read, and made for regular, at-home investors… And today, it’s totally free -- but won’t be for long.

JPM's Banking Build: $500 Monthly Bets Could Grow a Solid Five-Year Foundation

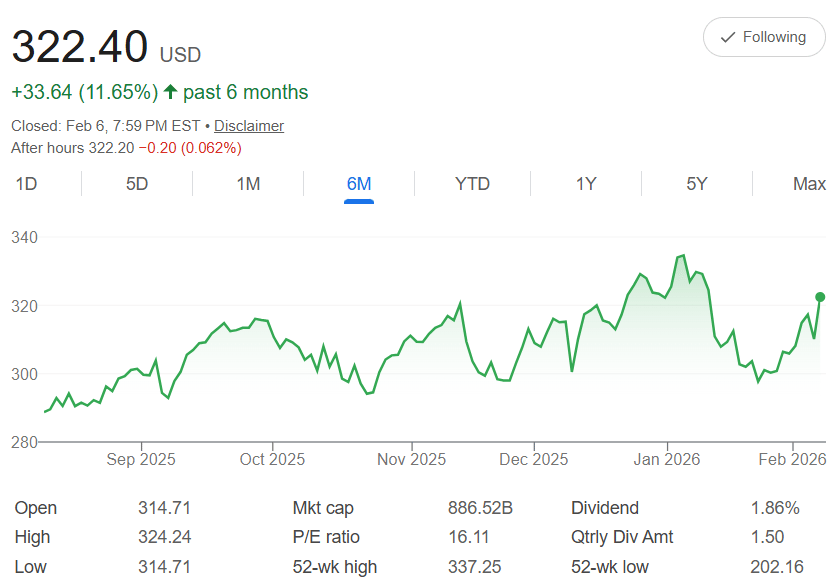

Five years ago, JPMorgan Chase $JPM ( ▼ 0.09% ) shares were trading around $119 each. Today, it's closed at $322.40—a steady 171% increase that reflects its position as one of the world's strongest banks, earning reliably from consumer banking, investment banking, commercial lending, asset management, and market-making activities. The chart shows a clear long-term upward path from 2022 lows, with consistent gains through 2024–2026, and a 52-week high of $337.25 showing the stock is still near its strongest recent levels.

In straightforward terms, the compound annual growth rate (CAGR) over the past five years is 22.1%. That's the average yearly gain—calculated by raising the total growth factor to the 1/5 power and subtracting 1. It means growing your money by roughly 22% each year, on average.

Most coverage tells you what happened. Fintech Takes is the free newsletter that tells you why it matters. Each week, I break down the trends, deals, and regulatory shifts shaping the industry — minus the spin. Clear analysis, smart context, and a little humor so you actually enjoy reading it.

Dollar-cost averaging (DCA) fits this reliable pattern perfectly: Invest $500 every month for five years, totaling $30,000. This buys more shares when prices are temporarily lower and fewer when they're higher, which helps smooth out normal market fluctuations. Projecting forward at the same historical CAGR, with a monthly growth rate of about 1.68% from $322.40, your position grows steadily.

After 60 months, your portfolio could reach approximately $49,800. That's a gain of about $19,800—a 66% return on your invested capital. The earliest contributions benefit most from compounding, while later ones still participate in the overall upward trend.

This projection follows historical performance, which does not guarantee future results. Large banks like JPMorgan are generally more stable than many growth stocks, but they are still affected by interest rates, economic cycles, credit quality, regulatory changes, and global events. The current P/E ratio of 16.11 is reasonable for a high-quality bank, and the 1.86% dividend yield provides dependable quarterly income ($1.50 per share).

With an $886.52B market cap and the 52-week high of $337.25 still very close, JPMorgan remains one of the most solid and widely respected financial institutions in the world. If you value consistency and are comfortable with the risks that come with any bank stock, DCA gives you a calm, disciplined way to participate over the long term. Your $500 monthly investments could build a meaningful, stable position by 2031.

Ready to keep building?

⚡🤖The Shift That Doesn’t Look Like a Shift (Yet)

There is a moment in every major investment cycle when the biggest opportunity looks uncomfortable, misunderstood, and inconvenient to track. That moment rarely arrives with headlines or clean narratives. It shows up quietly, buried under volatility, skepticism, and labels that no longer fit.

This is one of those moments.

Someone just spent $236,000,000 on a painting. Here’s why it matters for your wallet.

The WSJ just reported the highest price ever paid for modern art at auction.

While equities, gold, bitcoin hover near highs, the art market is showing signs of early recovery after one of the longest downturns since the 1990s.

Here’s where it gets interesting→

Each investing environment is unique, but after the dot com crash, contemporary and post-war art grew ~24% a year for a decade, and after 2008, it grew ~11% annually for 12 years.*

Overall, the segment has outpaced the S&P by 15 percent with near-zero correlation from 1995 to 2025.

Now, Masterworks lets you invest in shares of artworks featuring legends like Banksy, Basquiat, and Picasso. Since 2019, investors have deployed $1.25 billion across 500+ artworks.

Masterworks has sold 25 works with net annualized returns like 14.6%, 17.6%, and 17.8%.

Shares can sell quickly, but my subscribers skip the waitlist:

*Per Masterworks data. Investing involves risk. Past performance not indicative of future returns. Important Reg A disclosures: masterworks.com/cd

What looks like “Bitcoin miners” on the surface is increasingly something else underneath: power-dense, energy-secured, purpose-built infrastructure that happens to be standing exactly where artificial intelligence now needs to expand.

AI is not just a software story. It is an electricity story. A land story. A cooling story. A scale story. And above all, it is an infrastructure story.

The companies positioned to win are not always the ones with the flashiest chips or loudest marketing. They are the ones that already solved the hardest problems:

• Securing massive power contracts

• Building industrial-grade facilities

• Operating at scale under energy constraints

• Surviving extreme volatility

That combination is rare. Bitcoin miners had to master it early or disappear.

Now, the market is slowly realizing something important: the same infrastructure that once secured blockchains can secure AI workloads—often faster and cheaper than building from scratch.

This is not a clean pivot. It is uneven, volatile, and uncomfortable. Which is precisely why the upside exists.

The Lower Rungs: Optionality, Not Perfection

Some companies on this list sit lower not because they lack potential, but because their optionality is still unrealized.

Marathon Digital $MARA ( ▼ 2.18% ) remains fully exposed to Bitcoin. That keeps the stock volatile and sentiment fragile. Yet the physical reality matters: large-scale facilities across Montana, Texas, and New York, paired with hosting capabilities already in place. If and when the business model expands beyond pure mining, the groundwork is already built. High short interest reflects doubt—but doubt is often where optionality begins.

TeraWulf $WULF ( ▲ 16.52% ) represents a different angle. Its edge is energy. Low-cost, purpose-built power centers originally designed for mining are now increasingly relevant to data center economics. Institutional ownership has begun to form—not for hype, but for infrastructure. Even after strong performance, it still trades below consensus valuation, signaling that the market may not yet be fully pricing in the long-term use case.

Bit Digital $BTBT ( ▲ 0.56% ) sits at the speculative end of the spectrum. Smaller, less diversified, and still tied to Bitcoin price action, it only becomes meaningful if the transition to high-performance compute materializes. Analysts watching this name see it as a binary story—riskier, yes, but with asymmetry if execution follows intention.

These names are not about certainty. They are about embedded options—assets waiting for the right demand curve to activate.

Discipline, Scale, and the Middle of the Curve

Moving up the list, the narrative changes from possibility to execution.

Cipher Mining $CIFR ( ▲ 13.78% ) has built its reputation quietly. The focus is not speed, but discipline—cheap electricity, controlled balance sheets, and measured growth. Even after a sharp pullback, the stock remains significantly higher year over year, reflecting resilience rather than hype. This is what infrastructure looks like when it is run conservatively in a speculative sector.

Bitfarms $BITF ( ▲ 5.61% ) brings something often overlooked: geographic diversification. International power access, multiple operational sites, and years of operational history give it durability. Analysts still see meaningful upside, largely because the market tends to underestimate boring, reliable infrastructure.

Riot Platforms $RIOT ( ▲ 3.6% ) is about scale. Massive facilities. Deep power access. Proven profitability. In a future where AI compute becomes constrained by energy availability, scale stops being a nice-to-have and starts becoming a valuation driver. Riot’s current pricing reflects Bitcoin exposure—but its assets tell a broader story.

Core Scientific (CORZ) holds the largest data center footprint in the Bitcoin mining universe. The stock has tracked Bitcoin lower, but the physical assets remain intact and valuable. If AI workloads increasingly occupy this footprint, the business could be repriced entirely differently. Markets are slow to separate asset value from narrative momentum—but they eventually do.

This is the middle ground: companies where the risk is execution, not imagination.

When the Market Starts to Re-Label the Business

At the top of the list, the market has already begun changing the label.

Hut 8 $HUT ( ▲ 7.22% ) is no longer just discussed as a miner. The transition toward AI infrastructure is active, not theoretical. While profitability remains a work in progress, analyst sentiment has shifted materially, with price targets moving higher in recent weeks. The stock’s strong performance reflects growing confidence that this pivot is real.

Iris Energy $IREN ( ▲ 10.33% ) has gone further. The market increasingly treats it as a data center play with a Bitcoin legacy—not the other way around. Extreme volatility remains part of the story, but so does extraordinary momentum. Even after substantial gains, consensus expectations still point higher, underscoring how early this re-rating may be.

And then there is Applied Digital $APLD ( ▲ 9.47% ) —the clearest case study of what success looks like when the pivot is fully embraced.

Once discussed as a miner, it is now firmly positioned as AI infrastructure. Hyperscalers are engaging. Demand has surged. Earnings reflected a dramatic increase in utilization and interest for its facilities. Institutions are building positions. Short interest remains elevated, but often does in names undergoing rapid reclassification.

This is not speculative transition. This is operational transformation.

The Real Thesis: Infrastructure Always Wins First

The temptation is to view this as a list of stocks. That misses the point.

This is about recognizing where AI’s physical bottlenecks will be, and who already solved them before the rest of the market caught on.

AI does not scale on optimism. It scales on electricity, land, cooling, and uptime. These companies already operate under those constraints daily. They have survived brutal cycles, hostile pricing, and extreme capital markets.

That survival matters.

Not every name here will succeed. Some transitions will stall. Some balance sheets will break. Volatility will remain relentless.

But history is clear on one thing: when a new technology wave arrives, infrastructure owners are repriced before the crowd understands why.

For investors who do not have time to track every headline, every earnings call, every narrative shift—this is about seeing the shape of the opportunity early and letting time do the heavy lifting.

The market may still call them Bitcoin stocks. The assets already tell a different story.

And the next decade will decide which label actually mattered.

Ready to Revolutionize Your Wealth?

Here's what's waiting for you:

📈 Step-by-Step Guide: Start Investing in Minutes with Our Chosen Online Broker

🔍 Expert Insights: Uncover the Strategies Behind Our Recommended Smart Portfolios

💼 Easy Diversification: Gain Exposure to a Wide Range of Assets with Just a Few Clicks

💰 Long-Term Growth Potential: Build a Portfolio for Consistent Returns Over Time.

Fast Track to Build a Winning Portfolio Blueprint

Transform your investment journey with our step-by-step guide, enabling you to start investing in minutes through our trusted online broker. Discover expert insights into our smart portfolios that ...

💸 Paying the bills

Is Your Portfolio Ready for This?

Here's the uncomfortable truth:

The smartest investors in the world are already preparing for a crash before 2026 ends.

The warning signs aren't coming — they're already here:

– Gold is at record highs (the world’s richest investors are sprinting to safety).

– NASDAQ is trading at bubble levels not seen since 2000.

– Global conflicts are accelerating, not cooling.

The market doesn't ring a bell before it collapses. When it happens, it will be overnight… and millions will wake up too late.

If you're still "waiting for a sign"… this is it.

We’ve created a free crash protection eBook showing you how to protect your portfolio now, with the exact stocks and strategies to hold when the storm breaks.

By the time the headlines confirm it, the opportunity will be gone — and you’ll be left watching from the sidelines.

Get the Free Report Before the Crash Begins

Refind - Brain food is delivered daily. Every day, we analyze thousands of articles and send you only the best, tailored to your interests. Loved by 510,562 curious minds. Subscribe.

TOP MARKET NEWS

Top Market News - February 9, 2026

Best ETFs to Buy for Long-Term Investors

U.S. News highlights top ETFs suited for long-term investors, emphasizing diversification, low costs, and consistent performance over time.

Tip: Long-term ETFs work best when paired with patience and regular contributions.

Financial Experts Share Simple Retirement Advice for 2026

Experts offer practical guidance on protecting retirement savings, maximizing contributions, separating short- and long-term funds, and treating retirement income like a steady paycheck.

Tip: Review your retirement plan regularly and capture any employer match—it's free money that compounds over time.

3 Warren Buffett–Style ETFs for a Golden Retirement

24/7 Wall St. explores ETFs inspired by Warren Buffett’s philosophy, focusing on quality businesses, value principles, dividends, and steady long-term returns.

Tip: Buffett-style investing favors simplicity, durability, and long holding periods.

Why I Am Never Selling This Broad Market ETF

The Motley Fool shares why the Vanguard Total Stock Market ETF (VTI) remains a top pick for permanent holding, thanks to broad diversification and resilience across market cycles.

Tip: Conviction matters—owning a truly diversified ETF can reduce the urge to overtrade and let compounding work uninterrupted.

Advertise with Investing Wise Academy

Elevate your financial brand with targeted exposure to savvy investors and market enthusiasts. Join us early for premium discounts and a compelling story that lands in the right inboxes. Let’s grow together!

Partner with UsPROMO CONTENT

Can email newsletters make money?

As the world becomes increasingly digital, this question will be on the minds of millions seeking new income streams in 2026.

The answer is—Absolutely!

That’s it for this episode!

Thank you for taking the time to read today’s email! Your support is what allows me to send out this newsletter for free every day.

What do you think of the new format? Please provide your feedback in the poll below, and if you find the newsletter valuable, feel free to share it with other investors!

How would you rate today's newsletter?

Disclaimer: This newsletter is for informational purposes only and should not be considered financial advice. Please consult with a financial advisor before making any investment decisions.