Most retirement advice obsesses over a number—62, 65, or some culturally “accepted” age—but the reality is far more nuanced. True retirement isn’t a date on the calendar; it’s a financial state where your income reliably covers expenses without dependency on full-time work. For today’s investor, this distinction is critical. Social norms, cognitive bias, and peer pressure often push people to plan around arbitrary ages instead of actual cash flow needs. By focusing on essentials, optional income streams, and partial retirement strategies, you can create flexibility, reduce risk, and smooth the transition into full financial independence. Retirement becomes less about a sudden stop and more about intentional progress toward freedom.

At the end of the newsletter, we break down a practical framework showing how part-time work, flexible income, and spending awareness can turn retirement from a distant milestone into a step-by-step journey toward real optionality.

Let’s embark on this transformative journey together and position your portfolio for success in this evolving market landscape!

Be sure to read through to the end to catch all the valuable insights this newsletter delivers to your inbox today.

Presented By MarketBeat

MarketBeat releases Top 10 Stocks to own report

While the crowd’s chasing yesterday’s headlines, the real money’s brewing in the shadows.

2026’s megatrends - AI’s takeover, consumer empires doubling down, aerial taxis rewriting travel - are already here.

And Wall Street’s too busy navel-gazing to notice.

Our 10 Stocks Set to Soar in 2026 report cracks the code on those megatrends, giving you the name and ticker of the companies at the forefront of each one.

MarketBeat’s analysts sifted the chaff to deliver these 10 picks…

And they could very well be your ticket to profits the masses will miss.

Free today, after that, it’s strictly for paid members.

LLY's Medicine Momentum: $500 Monthly Bets Could Grow a Five-Year Health Fund

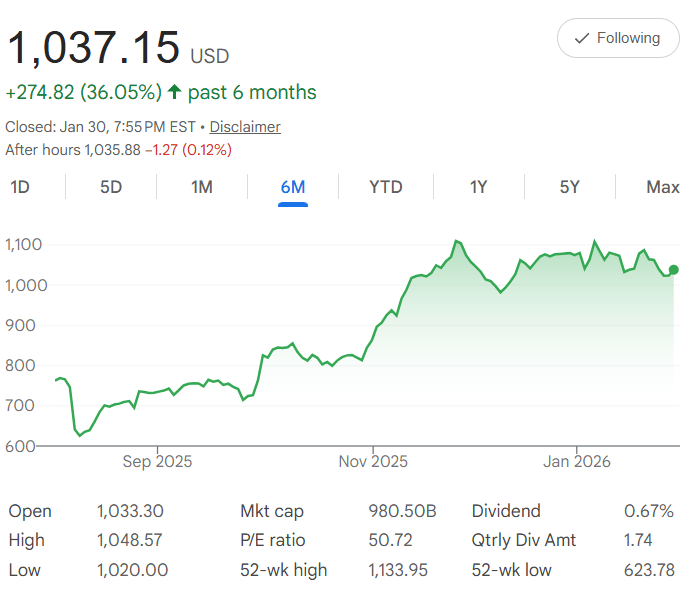

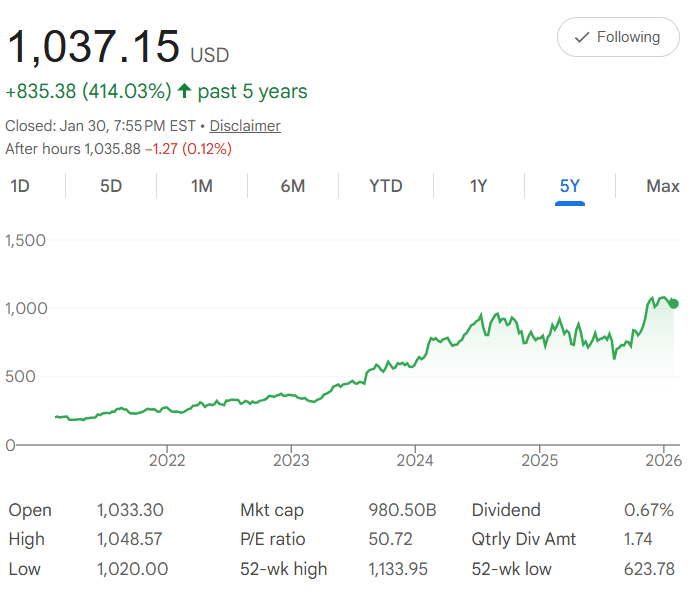

Five years ago, Eli Lilly and Company $LLY ( ▲ 3.66% ) shares were trading around $166 each. Today, it's closed at $1,037.15—a powerful 414% rise that comes from blockbuster success with weight-loss and diabetes drugs Mounjaro and Zepbound, plus strong progress in Alzheimer's treatments and oncology.

The chart shows a clear long-term upward path from 2022 lows, with consistent gains through 2025 and early 2026, and a 52-week high of $1,133.95 showing the stock has already reached very high ground.

In simple terms, the compound annual growth rate (CAGR) over the past five years is 44.1%. That's the average yearly increase—calculated by raising the total growth factor to the 1/5 power and subtracting 1. It means growing your money by roughly 44% each year, on average.

If you work in fintech or finance, you already have too many tabs open and not enough time.

Fintech Takes is the free newsletter senior leaders actually read. Each week, we break down the trends, deals, and regulatory moves shaping the industry — and explain why they matter — in plain English.

No filler, no PR spin, and no “insights” you already saw on LinkedIn eight times this week. Just clear analysis and the occasional bad joke to make it go down easier.

Get context you can actually use. Subscribe free and see what’s coming before everyone else.

Dollar-cost averaging (DCA) makes this straightforward: Invest $500 every month for five years, totaling $30,000. This buys more shares when prices are lower and fewer when they're higher, which helps smooth out any temporary pullbacks. Projecting forward at the same historical CAGR, with a monthly growth rate of about 3.10% from $1,037.15, your position compounds steadily.

After 60 months, your portfolio could reach approximately $84,200. That's a gain of about $54,200—a 181% return on your invested capital. The earliest contributions benefit most from compounding, while later ones still capture very strong overall growth.

This projection follows historical performance, which does not guarantee future results. Pharma stocks like LLY are influenced by drug approvals, patent expirations, competition, pricing pressure, and clinical trial outcomes.

The current P/E ratio of 50.72 reflects high expectations for continued earnings growth, and the 0.67% dividend yield provides modest but reliable quarterly income. With a $980.5B market cap and the 52-week high of $1,133.95 still very close, LLY remains one of the most powerful growth stories in healthcare.

If you're comfortable with the risks and believe in the company's ability to keep delivering new treatments, DCA lets you participate consistently without trying to time the market. Your steady $500 monthly investments could build a very substantial position by 2031. Ready to keep the prescription flowing?

💰⏳Retirement Reimagined: Cash Flow, Choice, and the Real Timeline

Picture turning 65. The alarm clock is silent. No traffic, no meetings, no obligations. At first glance, freedom seems effortless. But take a moment to examine reality: your mortgage isn’t gone, bills still arrive, groceries cost the same. The calendar flipped, but your finances didn’t.

Retirement, despite the cultural obsession with age, is not a milestone—it’s a financial state. It’s the day when income reliably covers expenses without dependency on active work. That distinction matters because most retirement advice frames a date, not cash flow, which is the actual determinant of financial freedom.

Historically, 65 is arbitrary. In Germany, when Otto von Bismarck created the first formal pension system, the retirement age was 70, not 65. Bismarck was 74, and life expectancy debates were secondary. The U.S. Social Security system, established in 1935, adopted 65 after political compromise, actuarial calculations, and fiscal considerations—not a statement about human capability. At the time, average life expectancy at birth ranged between 58–62, but adults reaching 21 often lived past 65.

For today’s investor, this underscores a simple truth: retirement timing should be rooted in finances, not tradition. Anchoring decisions to 62 or 65 may feel comforting, but it risks misalignment between financial capacity and lifestyle expectations.

Cash Flow is King: Expenses, Income, and the Real Numbers

Understanding retirement requires understanding what money actually buys. The Bureau of Labor Statistics shows households headed by 65–74-year-olds spend roughly $64,000 per year (~$5,300 per month). Essential expenses—housing, utilities, food, insurance—account for the majority. Non-essential spending, such as travel or entertainment, is variable and declines with age. By 75, average spending drops 19%, and by 85, it decreases nearly a third.

The implication is profound: retirement planning isn’t about achieving a fixed nest egg, it’s about matching income to essential outflows and adjusting expectations over time. Conventional guidance suggests replacing 70–80% of pre-retirement income, but that is a starting point, not a rule. Variables such as location, lifestyle choices, healthcare costs, debt obligations, and discretionary spending will dictate the true target.

For the focused investor, this reframes retirement as a dynamic cash flow problem, not a deadline to be feared. The goal becomes achieving optionality: enough income to cover essentials while retaining freedom to make work optional, rather than mandatory.

Optionality, Part-Time Work, and Strategic Flexibility

Retirement as choice rather than cessation reframes decision-making. Optionality is the ability to work if desired, and stop if preferred, without financial strain. Consider this example:

Monthly essential expenses: $4,000

Social Security + investment income: $2,800

Gap: $1,200

Filling this gap doesn’t require full-time work. Part-time consulting, freelancing, or entrepreneurial activities producing $1,200–$1,500 per month can eliminate the shortfall, allowing one to leave a full-time job while maintaining financial independence.

Partial retirement is not a new concept. Germany’s partial retirement programs gradually reduce work hours over 3–6 years while supplementing income with pension benefits. The principle applies universally: gradually reducing dependence on earned income lowers risk, maintains engagement, and smooths the transition into full optionality.

This approach also affects psychological well-being. Work is often a source of structure, social connection, and purpose. Retiring abruptly can create identity and lifestyle gaps. Optionality ensures continued engagement on one’s own terms, enhancing both financial and emotional resilience.

Behavioral Insights: Age Anchors, Peer Pressure, and Cognitive Bias

Human psychology complicates financial decisions. Social norms and peer behavior heavily influence retirement timing. Studies show 87% of Americans associate retirement with ages 62 or 65, not actual readiness. Peer behavior matters: a one-year shift in average retirement age corresponds to a three-month shift in individual retirement timing.

Cognitive biases, particularly affective forecasting errors, further distort planning. Many overestimate dissatisfaction with retirement or underestimate adaptability. The result: some delay retirement unnecessarily, while others retire too early and find the transition financially or socially challenging.

For investors, awareness of these patterns allows decisions to be based on personal circumstances rather than societal expectation. Retirement is not a cliff—it is a continuum where each financial milestone expands optionality. The strategy is to measure progress against real cash flows, not calendar dates.

A Practical Framework for Building Retirement Optionality

To build a robust retirement strategy, focus on these five principles:

Retirement is a sliding scale: Achieving partial financial independence—covering essential expenses—transforms work into choice rather than obligation. Full retirement may follow, but partial freedom is meaningful.

Expenses decline naturally: Household spending decreases with age. Planning for variable spending reduces unnecessary saving pressure.

Income flexibility extends freedom: Part-time work or low-intensity revenue streams reduce dependence on savings and allow gradual lifestyle adjustment.

Long horizons require patience: A 65-year-old may live 20+ years. Planning should accommodate decades, not months.

Social pressure is adjustable: Awareness of peer influence and societal norms allows decisions aligned with personal goals, not external expectations.

Ultimately, retirement is a condition built over time. Each dollar saved, each investment decision, each partial work arrangement contributes to long-term optionality. There is no sudden finish line—there is a steady, intentional progression toward financial freedom.

For the busy, data-driven investor, this perspective transforms retirement planning from a stressful countdown into a structured, measurable journey, where financial and lifestyle choices align with personal priorities, not arbitrary ages.

Ready to Revolutionize Your Wealth?

Here's what's waiting for you:

📈 Step-by-Step Guide: Start Investing in Minutes with Our Chosen Online Broker

🔍 Expert Insights: Uncover the Strategies Behind Our Recommended Smart Portfolios

💼 Easy Diversification: Gain Exposure to a Wide Range of Assets with Just a Few Clicks

💰 Long-Term Growth Potential: Build a Portfolio for Consistent Returns Over Time.

Fast Track to Build a Winning Portfolio Blueprint

Transform your investment journey with our step-by-step guide, enabling you to start investing in minutes through our trusted online broker. Discover expert insights into our smart portfolios that ...

💸 Paying the bills

File crypto taxes in minutes

Easily import you crypto transactions and file your taxes in minutes with TurboTax, H&R Block, or your own tax professional. Save time and maximize your refund using our crypto tax software.

Get started

Refind - Brain food is delivered daily. Every day, we analyze thousands of articles and send you only the best, tailored to your interests. Loved by 510,562 curious minds. Subscribe.

TOP MARKET NEWS

Top Market News - February 7, 2026

Best Stocks to Buy This Year

U.S. News identifies top stock picks for 2026, focusing on companies with strong fundamentals, growth prospects, and potential long-term gains.

Tip: Look for stocks with solid earnings and competitive advantages for durable performance.

A Rare Move in the Stock Market

The Motley Fool reports on a unique market occurrence that has only happened once before, offering perspective on potential risks and opportunities.

Tip: Unusual market events can create volatility—consider defensive positioning or selective entries.

5 ETFs Robinhood Investors Are Loving

The Motley Fool highlights five ETFs that are trending among Robinhood users, reflecting retail investor interest and market sentiment.

Tip: Popular ETFs can move quickly—ensure your allocations align with your risk tolerance.

U.S. Gold Demand Trends – Full Year 2025

World Gold Council provides insights into U.S. gold demand trends for 2025, including investment, jewelry, and technology sectors.

Tip: Understanding gold demand can guide commodity exposure and diversify your portfolio.

Advertise with Investing Wise Academy

Elevate your financial brand with targeted exposure to savvy investors and market enthusiasts. Join us early for premium discounts and a compelling story that lands in the right inboxes. Let’s grow together!

Partner with UsPROMO CONTENT

Can email newsletters make money?

As the world becomes increasingly digital, this question will be on the minds of millions seeking new income streams in 2026.

The answer is—Absolutely!

That’s it for this episode!

Thank you for taking the time to read today’s email! Your support is what allows me to send out this newsletter for free every day.

What do you think of the new format? Please provide your feedback in the poll below, and if you find the newsletter valuable, feel free to share it with other investors!

How would you rate today's newsletter?

Disclaimer: This newsletter is for informational purposes only and should not be considered financial advice. Please consult with a financial advisor before making any investment decisions.